The "exchange" over at New York magazine vaguely circled around credit default swaps, the mortgage crisis, if John McCain and Phil Gramm are to blame, and the shaky issue of suggesting loans to minorities were at the heart of the crisis.

First, a chunk of the exchange between Byron York and Matt Taibbi:

B.Y. I think that Fannie Mae and Freddie Mac were also major factors. And I believe that many of the problems in the mortgage area can be attributed to the confluence of Democratic and Republican priorities: the Democrats' desire to give mortgages to people, particularly minorities, who could not afford them, and the Republicans' desire to achieve an "ownership society," in part by giving mortgages to people who could not afford them. Again, I believe that if you are suggesting that the financial crisis is a Republican creation, or even more specifically a McCain creation, I think you're on pretty shaky ground.

M.T. Oh, come on. Tell me you're not ashamed to put this gigantic international financial Krakatoa at the feet of a bunch of poor black people who missed their mortgage payments. The CDS market, this market for credit default swaps that was created in 2000 by Phil Gramm's Commodities Future Modernization Act, this is now a $62 trillion market, up from $900 billion in 2000. That's like five times the size of the holdings in the NYSE. And it's all speculation by Wall Street traders. It's a classic bubble/Ponzi scheme. The effort of people like you to pin this whole thing on minorities, when in fact this whole thing has been caused by greedy traders dealing in unregulated markets, is despicable.

The folks at right-leaning Power Line are pissed. And perhaps understandably so. Their main beef is that Taibbi talks like he knows what he's talking about. I think it's safe for any partisan to admit that the housing/mortgage/bank/credit/Wall St. crisis is, well, complicated—complicated enough as to make any snap answer look ridiculous. Thus, their challenge.

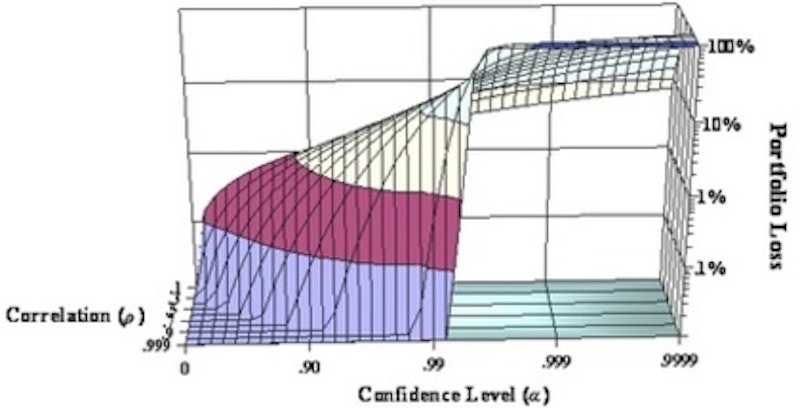

Mr. Taibbi, explain this "simplified one-factor Vasicek model used by Basel II regulations as a first approximation of risk-weighted capital for credit portfolios":

I don't think Mr. Taibbi will seek to explain just what this graph is saying. It's fair to point out that for us average peeps this graph would make for ugly wallpaper and that's it. I can't say if it makes a worthy challenge. But the notion of expertise—or dare I say it, the elite—is very, very pertinent in a situation like this.

Now, the challenge itself isn't coming from Power Line. It's coming from a friend—" a real expert"—of contributor John Hinderaker:

This arrogant [person] lit into Byron York repeatedly challenging him to explain the CDS concept...while misstating the size of the market...by giving only the notional value rather than the FMV of the swaps, on a netted basis...if he doesn't know what that means...he is an ignorant, pompous windbag...and if he does, then he is a mendacious, disingenuous left-wing propagandist...not too pretty either way.

Snark and blinkered partisanship aren't going to help anyone out of this mess. It's going to take a lot of ivory tower types and pragmatic politicians to pull this off. One upmanship in terms of who knows what is only going to muddy the waters—so will pretending to know something you don't.

Sadly, it looks like we're going to be seeing more finger-pointing than problem-solving in the short run.